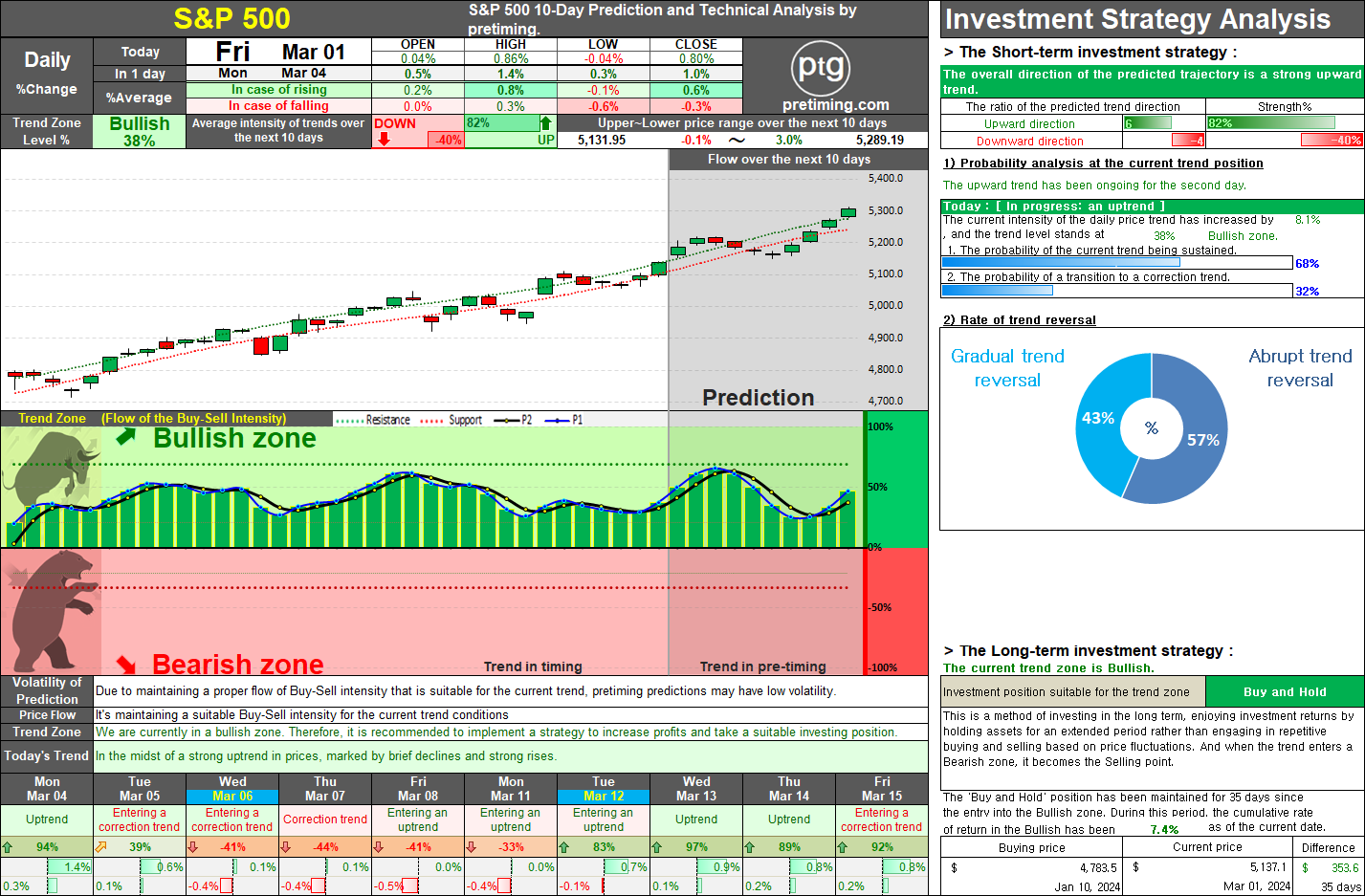

S&P500. The S&P 500 is currently in an uptrend within the Bullish zone, but weakening buying momentum indicates a potential shift to a correction phase. Over the next 1-2 weeks, increased selling pressure is expected to deepen this downward movement.

Weekly S&P 500 Outlook. The S&P 500 is currently maintaining an uptrend within the Bullish zone. However, the buying momentum is gradually weakening, suggesting an imminent transition into a correction phase. This trend is expected to manifest over the next 1-2 weeks, with selling pressure intensifying and the downward movement becoming more pronounced, leading to a correction phase. This correction trend is anticipated to continue until mid to late June. If the correction stays within the expected range, the market is projected to re-enter an uptrend around late June to early July. May 20, 2024 S&P 500 closing price 5,304.7 0.03% ◆ [Long-term strategy] The current trend zone is Bullish and Investment position suitable for the trend zone is Buy and Hold. The trend within a Bullish zone is divided into an 'Uptrend' in the upward direction and a 'Correction Trend' in the downward direction. I